Our financial services social strategy recommendations and best-practice case studies put you in the driving seat to accelerate your financial services’ ROI from digital marketing in 2024

Over the past few years, financial service organizations have embraced social selling programs and employee advocacy. Those integrating the data they have generated by their financial services social media strategies into a single source of customer truth are flourishing.

Financial organizations are effectively engaging with digital customers, differentiating with real-time communication via social channels. There has been a clear shift from pre-review to post-review with the industry treating social media posts as interactive communication rather than static advertising.

Companies are recognizing that social media provides a wealth of value, enabling differentiation through human communication. They are driving value by integrating this with their CRM systems, tracking ROI, and ensuring compliance. To drive such value, organizations expect solutions to help them track ROI, integrate with CRM solutions, provide compliance, and offer best-in-class publishing tools.

Perception of social media for financial services

Social media is sometimes perceived as less relevant in financial services compared to other channels such as search, display, and aggregators. There are well-rehearsed objections to investing more in social media in financial services. However, we will see by the examples in this section that creative options are possible within the constraints of compliance.

Customer-centric social media trends

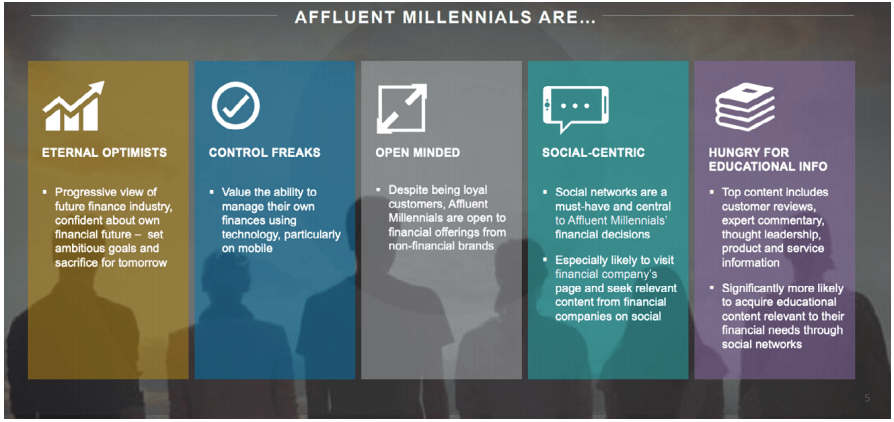

Owing to the financial sector having access to detailed customer data, we are seeing an increase in social advertising by the financial services sector, with Lookalike Audience modeling in Facebook ads increasing in popularity. This means segmenting the audience into groups of people who ‘look like’ their current customers and website visitors. Mobile video ads on YouTube and retargeting LinkedIn prospects on Instagram in order to reach the same audience at a lower cost are also good ways of connecting with potential customers.

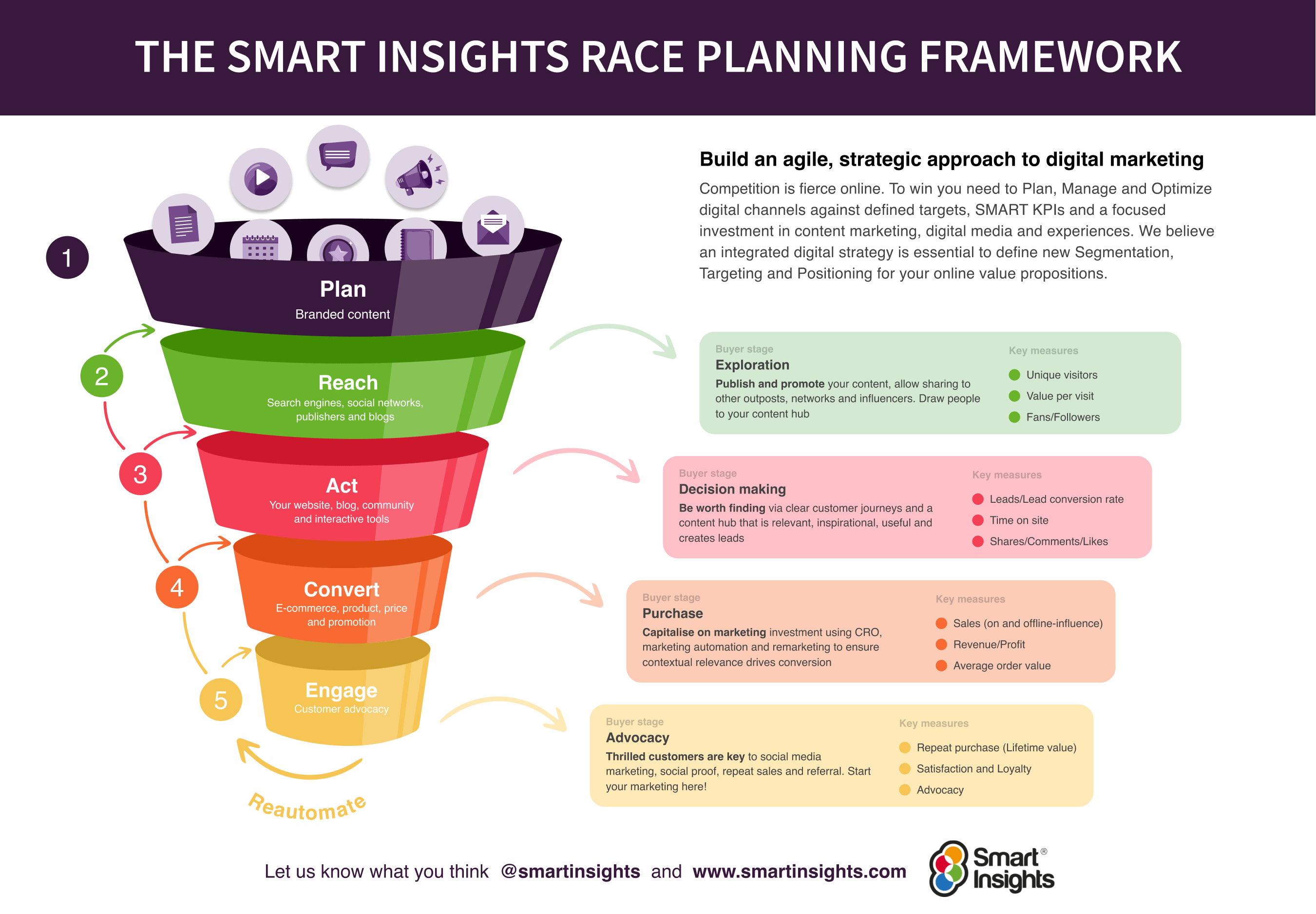

Moreover, Smart Insights offers financial services marketing strategy across all aspects of the marketing mix, plus strategy and planning for marketing leaders. As such, you can download our free RACE digital marketing plan template to inform your integrated strategy.

Financial services social media channels

Below, we’ve put together our social media strategy recommendations for financial services marketers based on the current trends and innovations in the sector. Social media is a huge part of your business’s online presence, that’s why we’ve broken it down, channel by channel.

Meta – Facebook and Instagram

Meta provides strong organic engagement, particularly with Gen Z and millennial clients, and for attracting new workforce talent. FS brands are falling behind and haven’t broadly adopted the visual platform. Meta’s advertising options are easy to manage, as mobile video engagement continues to rise, as well as extended advertising options, including ‘shoppable’ content.

Online lender, SoFi has successfully used mobile advertising campaigns on Instagram and Facebook to achieve a 39% increase in loan applications. The company’s Instagram posts demonstrate its approach to resonating with the customer.

LinkedIn remains the central social channel for financial services organizations, now reaching 590+ million professionals. 98% of the Forbes Fortune 500 list are using LinkedIn, with content amplification and connecting with prospective clients continuing to be the top reasons for use.

FinTech companies, who have typically invested in Facebook as their primary channel, are investing more in LinkedIn with FS organizations increasingly using their CEO or senior leadership figures to amplify their content through personal insights and thought leadership articles, such as Mastercard APAC’s 130% follower growth.

YouTube

This channel is commonly used amongst financial services organizations for extending the reach of TV advertising campaigns, building playlists with content relating to personal finance and investing topics, plus targeting high-value prospects with pre-roll advertising.

YouTube has seen increased adoption by the Fortune 500 with 75% of companies holding active accounts – a 67% year-on-year increase. According to ComScore, there has been a 26% year-on-year increase of YouTube mobile viewers aged 55-64 in 2018, with the channel reaching 95% of monthly online adults aged 55+.

Snapchat

Very few financial service organizations have mastered Snapchat. Its geotargeting tools, self-serve advertising tools, and location-based features could be used by the industry as a way of driving leads locally, for example, by local mortgage brokers to drive consultations with first-time home buyers. This, as well as searchable Stories, location-based Context Cards, and Snap Maps, could benefit the industry.

Twitter is commonly used by financial services organizations for amplifying content, monitoring brand mentions and customer complaints, and locating buyer-buyer-ready signals. All of the Fortune 500 insurance companies, commercial banks, and financial data service companies have a presence on Twitter.

Consumer privacy laws: GDPR and ePrivacy

You will be aware that the General Data Protection Regulation (GDPR) (Regulation (EU) 2016/679) came into force in all 28 countries in Europe in 2018. It is a regulation agreed by the European Union, which seeks to improve transparency and the effectiveness of data protection activities. The legislation highlights the importance of obtaining consent from new and existing customers, who subscribe to mailing lists and have their data stored in CRM and other systems.

Influencer marketing in financial services

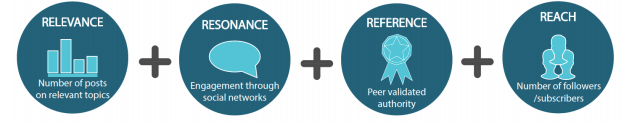

There is a wide variety of different influencers that you could engage with, so focus your engagement on certain types of people that you feel will best communicate your message to your target audience. According to Onalytica, there are four key measures of influence that you should analyze to find the key influencers in your market.

While these elements are important you need to consider the message they will be sending in the wider context of your audience. For example, controversial e-commerce tools enabling ‘Buy Now Pay Later’ is anticipated to expand at a compound annual growth rate of 26.1% between 2023 and 2030.

Enabling BNPL solutions brings merchants advantages such as higher CR%, AOV, improved brand experience, and instant customer cash flow. Some disadvantages include higher merchant fees and integration/accreditation challenges. Plus, BNPL is frequently associated with longer-term debt problems for customers.

Keep your financial services social media strategy consistent

Appreciating the strengths of each major social media platform assists financial marketers in establishing a focused and manageable social media strategy. A good example is TSB who has used social channels with a consistent tone of voice and frequent messaging promoting its brand position.

Smart Insights has a wealth of marketing training and tools designed for channel marketers to upskill and develop their knowledge as well as strategy and planning resources for those who manage them.

Since all our Smart Insights marketing solutions are integrated across our RACE Framework, you can confidently track and adapt the journeys which you know deliver the best results, integrated across multiple channels.

Social media campaigns are most effective when each platform is working together consistently under a common theme, with unique messaging and content types customized for each channel. Join Smart Insights to get instant access to our free RACE digital marketing plan template.